How To Guarantee Your Trading Profitability in 2024

How Mechanical Strategies Give You The Winning Edge, time and time again.

Platinum Trading Program

Mechanical rule-based trading strategies can be extremely beneficial for traders who are looking to take their financial investments to the next level. These strategies offer a number of advantages, including increased consistency and reliability, reduced emotional bias, and a higher potential for profits.

One of the main benefits of using a mechanical rule-based trading strategy is that it removes much of the emotional bias that can be present in manual trading. This can be especially beneficial for traders who are prone to making impulsive or irrational decisions based on their emotions. With a mechanical rule-based strategy, trades are executed automatically based on a set of pre-defined rules, without the need for subjective interpretation. This can lead to a more consistent and reliable approach to trading, reducing the impact of emotions and helping to maintain discipline.

Another advantage of using a mechanical rule-based trading strategy is that it allows traders to take advantage of their edge. An edge refers to a consistent and reliable advantage that a trader has over the market. This can be in the form of a particular skill, a unique approach to analysis, or access to valuable information. By relying on a set of mechanical rules, traders can ensure that they are taking advantage of their edge on a consistent basis, reducing the likelihood of making impulsive decisions that undermine their advantage.

Mechanical rule-based trading strategies can also be a great way to optimize trading performance. By relying on well-defined rules, traders can create a system that automatically adjusts to market conditions and can help to identify the best opportunities for profits. For example, a rule-based strategy might be designed to take profits when certain conditions are met, or to cut losses when certain warning signs appear. These rules can be automated, allowing traders to focus on other aspects of their business, while still taking advantage of the market’s opportunities.

Finally, mechanical rule-based trading strategies can be a great way to manage risk. By relying on a set of pre-defined rules, traders can ensure that they are taking a controlled and consistent approach to risk management. For example, a trader might set a rule that limits the amount of capital they are willing to risk on any one trade, or that requires them to close out a trade if certain market conditions are met. These rules can help to prevent traders from making impulsive decisions that can lead to large losses, and can help to ensure that the trader’s capital is being managed in a responsible and effective manner.

In conclusion, mechanical rule-based trading strategies offer a number of significant benefits for traders looking to take their financial investments to the next level. These strategies provide a more consistent and reliable approach to trading, reduce emotional bias, allow traders to take advantage of their edge, optimize trading performance, and help to manage risk. By relying on well-defined rules, traders can increase their chances of success and maximize their profits in the financial markets.

WB Trading’s Platinum Program includes four completely mechanical, rule-based, black and white setups, two of which are day-trade strategies and two of which are swing-trade strategies that they combine to aid diversification.

These edges solve the problem of having to use discretion and completely remove the need to guess, predict the market, use indicators, mark levels [everybody draws them differently…] and so on.

As soon as you have the rules, you can see every trade setup that has ever occurred, clear as day. Again, solving the problem of knowing where to trade, when to trade, etc.

It’s an extremely simple, time-efficient and most importantly consistent way to profit from the markets with no stress, no guesses, no predictions and no worry whatsoever.

Just clear trade setups, and a statistically proven source of edge.

What are their edges?

The D1 swing edge

This is a completely mechanical momentum-play that is traded using a single momentum indicator alongside raw price-action. The edge can be applied across all markets and all timeframes, and the setup is executed on using rules that entirely remove emotion from the trading process.

Price Reversion and Session Momentum Edges

The Price Reversion and Session Momentum edges are recurring price sequences and/or structures within each market that present a single setup at the start of every session. These setups can also be carried into other markets, too.

To go into more detail, after looking at the charts every single day for weeks and months on end it became clear that certain price points would either attract or repel price to or away from them. This happened extremely frequently, Statistics were collated on the occurrences, testing varying parameters that allowed us to profit from them, eventually we able to implement rules and from there, used this information to build both strategies.

Higher Timeframe Bias Bar

The Higher-Timeframe Bias Bar edge is a rule-based setup built around one bias-bar in particular and that can be applied to all markets and all timeframes. You can typically identify the bias-bar in question via a D1 timeframe which is beneficial due to the very low time-commitment required, before moving down to a H1 timeframe to place an order by following the rules, before then walking away. Again, removing emotion and discretion entirely.

The Results...Some Very Satisfied Customers

Here are some of the numerous reviews & testimonials from customers who have invested in the program, which has changed their lives.

Check out the hundreds of reviews on the their site below.

They are the ONLY trading company to guarantee your results.

Yes, you read that right.

They really Do guarantee your results!

Talk about putting your money where your mouth is.

But you might be thinking;

" Aren't the markets random?"

See, this is something most traders aren't aware of. Yes, in the very short-term i.e. second to second, anything can happen within a market. Yet in the longer-term, certain recurring price-sequences happen time and again, repeatedly.

These recurring price sequences are called "edges". And by putting mechanical 'rules' in-place, you’ll able to capitalise on them, every single time they occur. Day after day, week after week, month after month.

Better still, the "edges" that they’ve been trading for years, happen at certain times of the day, meaning you’ll know exactly when to be at the screen, and more importantly, when not to be. So you can actually live your life, rather than being tied to the screen for hours each day.

And you might be thinking;

"Ok, but how on earth can they guarantee results?"

It's simple. With mechanical 'rules' in-place (that never change, they’ve been using the exact same rules for almost a decade) They're able to fact-check them. By back and forward testing them.

That means that anyone who has the rules can see exactly what happened yesterday, last week, last month, last year. Performance is not only black and white, you are able to track it too.

And they’ve been tracking strategy performance as they've traded the "edges" year after year.

For this reason, because the "edges" have worked continuously, month after month, quarter after quarter, year after year, they are willing to guarantee that they continue working, just as they always have.

It's Gets Even Better....

Trade with someone else's money

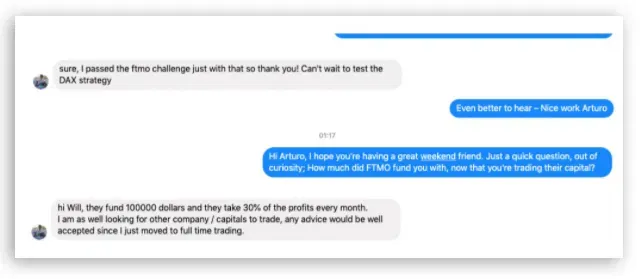

Arturo & other customers results were so consistent that they used the strategies to pass the FTMO test and received funded accounts, Arturo's was funded to the tune of $100k!

Imagine simplifying your trading, generating profit consistently, month after month & being able to amplify your earnings by trading a Proprietary company's funds to boot!

You could easily follow in Arturo's footsteps by leaning the simple rules, applying the rules & profiting the rules.

What are you waiting for?

Remember, it’s risk free with the 100% money back guarantee!

Click the link below to learn more today!

.png)